Get your business insurance quote started in 3 simple steps with JG Insurance Services LLC

General Lines Insurance Agency

Property, Casualty, Life, Accident, & Health

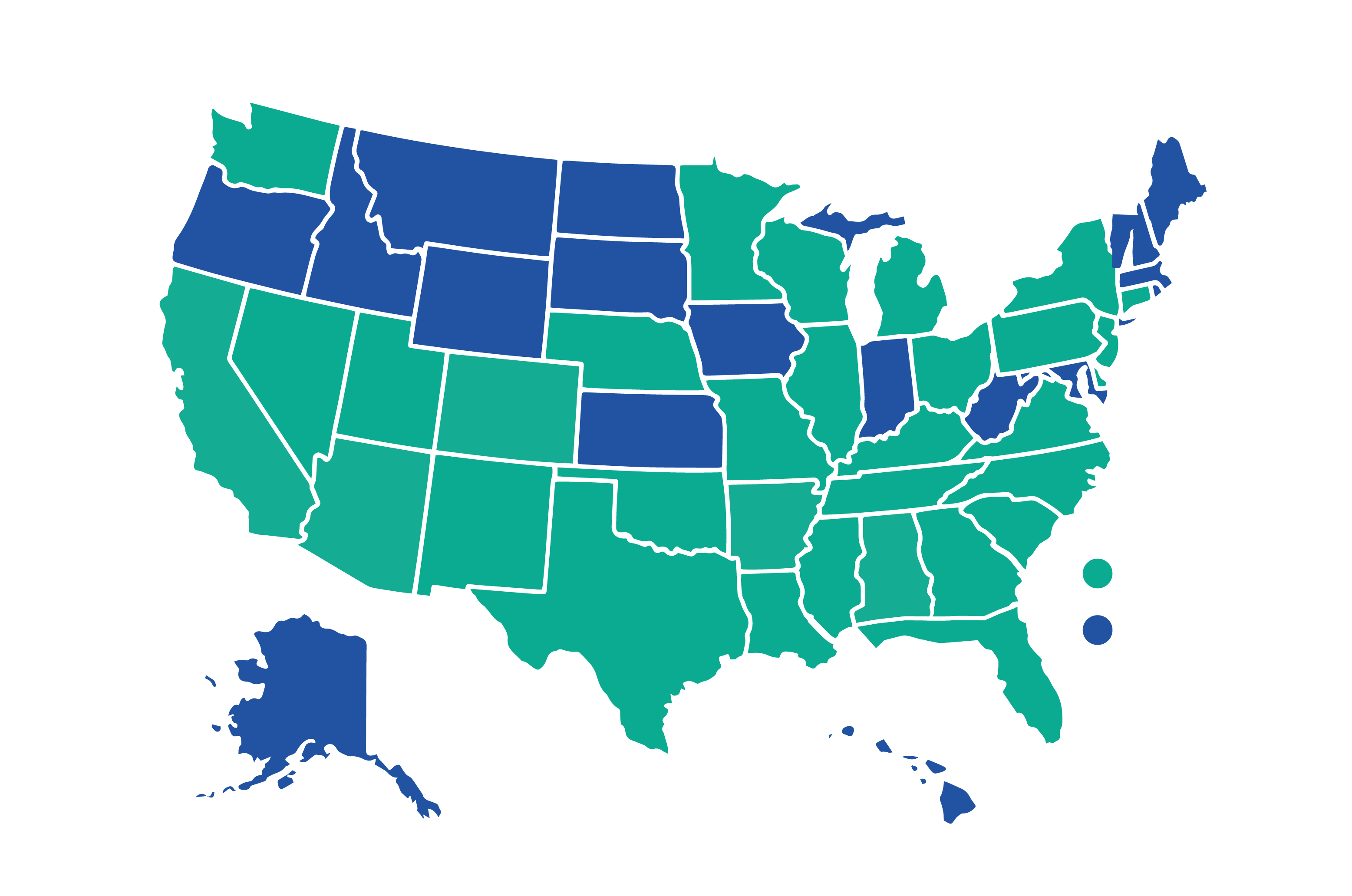

AL, AZ, CA, CO, CT, DC, DE, FL, GA, IL, KY, LA, MI, MN, MO, MS, NC, NE, NJ, NM, NV, NY, OH, OK, PA, SC, TN, TX, UT, VA, WA, WI

Domiciled in Texas